Life insurance payouts hit record high of $100 billion in 2021 – the first full year of mass COVID-19 vaccination

11/30/2022 / By Arsenio Toledo

American life insurance companies paid out a record $100 billion in death benefits in 2021, with most of the payouts being attributed to Wuhan coronavirus (COVID-19) deaths.

The American Council of Life Insurers (ACLI) noted that 2021 payouts rose by 11 percent year-over-year to $100.19 billion. This year’s increase comes on the heels of a 15 percent year-over-year rise in 2020, when death benefit payments totaled $90.43 billion. (Related: COVID JAB FALLOUT: Middle-aged people died at TWICE the expected rate last summer, according to life insurance data.)

The ACLI compiles data from annual filings submitted by life insurance companies to state insurance departments and noted that last year’s payout total is the highest amount life insurance companies have ever given to policyholder beneficiaries in a single year.

Last year’s annual increase marks the largest increase in payments since the 1918 flu pandemic, when life insurance payouts surged 41 percent. It is also far above the 4.9 percent average increase between 2011 to 2021.

Life insurance payments have been going up since 2019, with the number of life insurance policies bought last year being about six percent higher than in 2020, with about 46 million policies purchased in 2021. This bump has pushed the total amount of life insurance coverage in the United States to over $21 trillion.

Most of last year’s payouts came from individually owned life insurance policies, although a large chunk of the payouts also came from employers’ benefits programs.

The ACLI’s data does not show why the policyholders died, but the organization’s Vice President of Research and Chief Economist Andrew Melnyk said it is reasonable to attribute the bulk of the increases to COVID-19.

Melnyk added that more Americans have been purchasing life insurance plans and many people in the country are still succumbing to the disease.

“In uncertain times, people look for sources of stability and peace of mind,” said Melnyk.

Over a million people in the U.S. have died officially as a result of contracting COVID-19 since the pandemic began in 2020, according to data released by the Centers for Disease Control and Prevention, with over 460,000 dying last year despite the rollout of COVID-19 vaccines that are supposed to protect people from the disease.

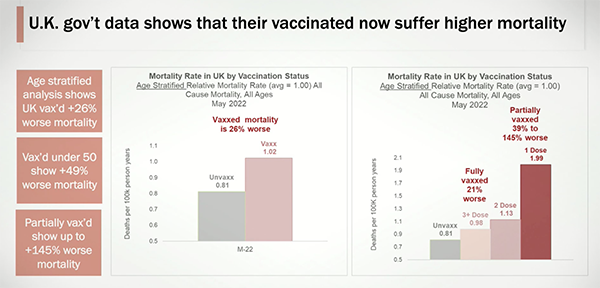

Number of deaths started to rise after rollout of COVID-19 vaccines

As vaccination rates against COVID-19 go up, more people continue to die allegedly due to the disease. Official data shows that more than 2,000 Americans are still dying from it per day.

In January, the OneAmerica insurance company CEO CEO Scott Davison noted that the death rate in the third quarter of 2021 is up 40 percent compared to pre-pandemic levels.

“We are seeing, right now, the highest death rates we have seen in the history of this business – not just at OneAmerica,” Davison said at the time. “The data is consistent across every player in that business.”

He pointed out that these deaths are occurring in working-age people – those between the ages of 18 and 64. In other words, most of the people dying were eligible to take the COVID-19 vaccine.

OneAmerica is a $100 billion insurance company that has had its headquarters in Indianapolis since 1877. The company has approximately 2,400 employees and sells life insurance, including group life insurance to employers nationwide.

Myrna Guerrero, a national sales director for Primerica, one of the country’s biggest sellers of term-life policies, noted that even young families had to deal with unexpected deaths. In two instances of term-life policies sold by her office, which handles the Greater Phoenix metropolitan area in Arizona, policyholders left behind families with three or more children and no immediate guardians.

“Obviously, we won’t take the pain away of losing somebody, but financially they will be okay,” said Guerrero of the two families. Her office handled 25 clients in 2021, with about half of those deaths attributed to COVID-19.

Primerica’s companywide death claims for 2021 were $2.25 billion, up by about 34 percent from 2020’s $1.69 billion.

Learn more about American healthcare and insurance claims at HealthCoverage.news.

Watch this clip from InfoWars discussing how life insurance companies are expected to sue COVID-19 vaccine manufacturers to cover payouts for the sudden explosion of deaths.

This video is from the InfoWars channel on Brighteon.com.

More related stories:

THE DIE-OFF IS HERE: Life insurance payouts skyrocket 258% as post-vaccine deaths rapidly accelerate.

Sources include:

Submit a correction >>

Tagged Under:

Big Pharma, biological weapon, covid-19, depopulation, genocide, health coverage, healthcare, infections, insurance, insurance payouts, life insurance, outbreak, pandemic, pharmaceutical fraud, spike protein, Vaccine deaths, vaccines

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG PHARMA NEWS